How to verify funds

When accepting checks, it's important to verify that the check is good before rendering services. Bounced checks have a visceral cost to your business and your sanity.

Depositing a bad check results in bank fees and additional steps to get the money you deserve. Use our check verification steps to find out if a check is good.

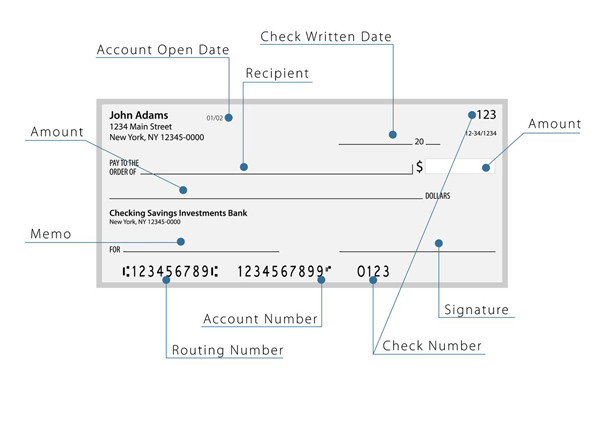

How to get the check routing number:| Verify routing number: | |

| Use the tool we built above | |

| Contact the bank | |

| Tell the customer service representative that you would like to verify a check | |

| On the call | |

| Give the bank account and routing numbers included in the check. | |

Will this definitively solve the issue of bounced checks?

Unfortunately, no. Once you've checked the funds are present, there are a couple of things that could go wrong.

1. The check could be a fake check.

2. The writer of the check may not own the checking or savings account that the check was written from. The owner will reverse the charges and leave you holding the bag.

3. Other withdrawals, account holds, debits, other checks cashed before yours, and many other items could deplete the money from the account before your check goes through.

Any alternatives?I personally recommend that you take cashier's checks (which are held to a higher standard than standard checks) or a certified check.

Other ways to do verificationIt is generally preferably to try to cash the check in-person at the bank. You can potentially avoid fees from this approach. In order to do that, you must visit a bank branch.

Finding a bank branch location near you.Check verification serviceWe also provide a check verification service that provides a very high-level of guarantee that the check is real. Please email us directly at sales@branchspot.com and we can get you set-up and verified in 10 minutes.

Due diligence1. Modern checks have a security box in the back of the check. This security box describes the security features on the check. It contains a warning that may warn off scammers (although it's not very likely to prevent a determined scammer), and it gives guidance on how to determine if the check is real. Examples of what it could indicate include watermarks, microprint, and other security items.

2. Gut feeling is a great check. If the person who gave you the check is exhibiting sketchy behavior, it's extra important to double-check the check (pun-intended).

3. Ask for cashiers checks or certified checks.